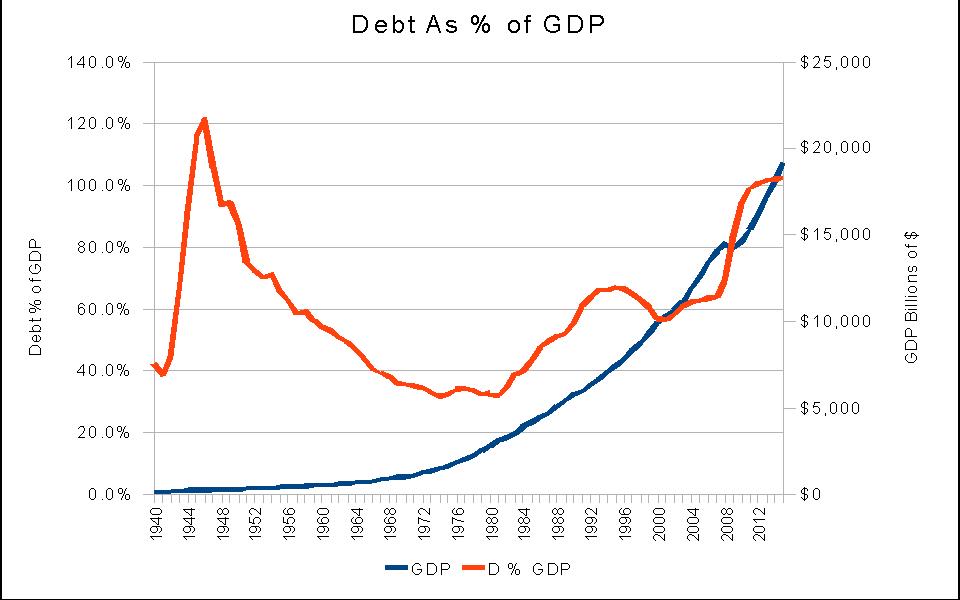

Lets start by looking at what is a reasonable amount of National Debt. I have to introduce GDP (Gross Domestic Product), and then show Debt as a percent of GDP. GDP is the total goods and services produced within a country in a year. It is the economic measure used to compare countries and judge the health of an economy. As an example, the start of a recession is defined as two consecutive quarters of negative GDP growth.

You can see that Debt declined as a percent of GDP after WWII until 1981, at which time National Income fell below National Spending, causing Budget Deficit. Economist tend to say that a country’s economy is on the verge of trouble when its debt reaches 90% of its GDP. That is where we are today. We were there during WWII and came out of it very nicely. Will we again? This doesn’t answer the question of what is a reasonable debt, but 90% of GDP is probably too high.

Who own all this debt? Who has loaned us money knowing that we will pay it back with interest, and we will. A US Treasury note is the safest investment in the world. Safer than stock, your local bank, or gold. The largest holder of Debt is the government itself, currently about 49% of the total. Most of this has been borrowed from the Social Security fund. The next largest holder of Debt is foreign governments. China owns 20.8% of internationally held Debt, which equates to about 10% of our total Debt. China doesn’t own the US yet. Japan is second, owning 9.2% of internationally held Debt, and ownership drops rapidly for other countries.

There isn’t much left to be borrowed from ourselves, so we will have to attract more outside loaners. This may require raising interest rates. This raises another issue, both economic and political.

It may cause the dollar to loose value on the world market. That will make foreign travel more expensive for Americans, and make our exports less expensive. This will increase demand in the US and create jobs. It will also cause the price of oil to rise. And it means we will pay back loans with less valuable dollars. Foreign countries will whine because they will be less competitive, and getting less return on their loans to the US. It’s all complicated.

In the next post I will get back to why we have so much deficit and debt, and look at the spending side of the budget. Paul will be exposed, but Peter has his coming too.

[print_link]

Leave a Reply