I’ve made a dead horse of the old adage, “Rob Peter to pay Paul.” In truth, neither are totally at fault. The government has been collecting less, spending more, and running up the debt. Today’s debate about spending cuts and the budgeted deficit are not close to solving the problem, and if nothing is done entitlement spending alone will bankrupt the country. On the bright side, the public and the government have recognized the problem. It may be recession and the plight of state’s budgets that has forced recognition.

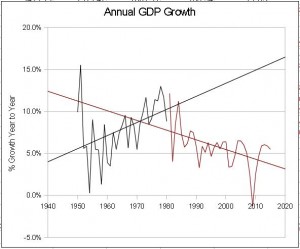

Lets take a quick look at the recession to see if you are justified in feeling so glum about the economy.  First note that annual GDP growth went negative for the first time in 60 years. Also observe that from 1950 to 1980 the trend in GDP growth was positive. Since 1980, the trend has been negative. This is very serious because GDP measures how robust the country’s economy is. Growth was mostly flat in the 90’s, which may have lulled us into thinking that things were swell, but until the trend turns positive, it will be hard sustain the life style we would like to become accustom to.

First note that annual GDP growth went negative for the first time in 60 years. Also observe that from 1950 to 1980 the trend in GDP growth was positive. Since 1980, the trend has been negative. This is very serious because GDP measures how robust the country’s economy is. Growth was mostly flat in the 90’s, which may have lulled us into thinking that things were swell, but until the trend turns positive, it will be hard sustain the life style we would like to become accustom to.

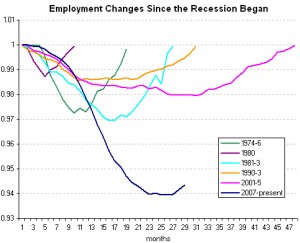

Another look at the depth of the recession can be seen in the continuing high unemployment.  More people are unemployed than in previous recessions, and they are staying jobless longer. This is compounded by higher paid manufacturing jobs are being replaced by lower paid service jobs. So, the worst recession ever drives income down and spending up just when the opposite is needed. Does this seem odd when US corporations profits are reaching record highs?

More people are unemployed than in previous recessions, and they are staying jobless longer. This is compounded by higher paid manufacturing jobs are being replaced by lower paid service jobs. So, the worst recession ever drives income down and spending up just when the opposite is needed. Does this seem odd when US corporations profits are reaching record highs?

There has been a tight link between increased corporate earnings, profit, and job growth. That link is no longer confined to the US. Many large businesses find close to half their sales offshore. We all want to buy low and sell high or at least more, and that is what American corporations are doing in the emerging economies of the world, where their sales and number of employees are growing. Scoff at the phrase, “globalization”, but it is the reality. Increasing US competitiveness is the only lasting way to increase US GDP and high paid employment.

Little is said about why we should lower Federal Debt, it just seems that we should. The high level of debt forces high interest payments. It forces additional borrowing when loans must be paid back, and it causes higher interest rates when seeking new loans. This all reduces the government’s flexibility in dealing with resource and Geo-political crisis. It constrains spending that will improve our national infrastructure and increase our global competitiveness.

The bullet must be bitten, and it won’t feel good. Federal income must increase and federal spending must decrease. US competitiveness must increase in high value products and services. If not, the negative trend in GDP won’t reverse. The high paying employment picture won’t improve, and the American life style won’t be what mom and dad remember.

[print_link]

Leave a Reply